how to file taxes for amazon flex

They can then use the app to select blocks of time consisting of days and hours when they want to deliver for the service. Its a progressive tax which means that the amount of tax youll owe depends on your income bracket.

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

I know the Amazon Flex app downloaded on my Android phone but how do I find it.

. This video shares information on where to find your 1099 expenses. Beyond just mileage or car expenses getting a 1099 from Amazon means that you can claim a lot of other expenses as tax write offs -- the phone you use to call residents with a locked gate the insurance and down payments on your car and many more expenses are considered tax deductible expenses. Use the Jump to W-2 link after searching.

You can search for W-2 in the search box to be taken to the entry screens for those. For example if youre in the 24 tax bracket and earn 50000 from Amazon Flex youll owe 12000 in federal income taxes 50000 x 024. Self Employment tax Scheduled SE is generated if a person has 400 or more of net profit from self-employment on Schedule C.

In addition to the federal taxes that we just discussed youll also need to pay state taxes. If you stay organized you can finish your taxes in 15 minutes because youre just transferring the information you already have. You pay 153 for 2014 SE tax on 9235 of your Net Profit greater than 400.

Filing Your Taxes 7287 views Jan 20 2020 172 Dislike Share Flexing With Flex Its almost time to file your taxes. Download the free app called File Manager by ZENUI ASUS Computer. Free software automatically fills forms.

You will need to report your business income to the IRS and pay any amount that is due. These tips will show you the easiest way to file taxes for Amazon Flex in 2020. Amazon flex driver taxes amazon flex taxes how to do taxes amazon flex.

Ad Confused about taxes. Increase Your Earnings. Click ViewEdit and then click Find Forms.

When the scheduled block begins drivers head to an Amazon delivery station or a nearby store or restaurant and then mark in the app that. Was this information helpful. Ill leave instruction links below.

Once you calculate what that percentage is for the tax year divide that number by 4 -- and you have your quarterly estimated tax payments. As a self-employed independent contractor you will have to pay taxes and self-employment tax on your business income. Its easy to file Amazon Flex taxes when you take the time to learn the basics.

Go to the Google Play store and follow these steps. Click Download to download copies of the desired forms. All of your 1099s get reported in the Self-Employment section including the construction job.

Hot bags courier bags. You will also have to pay unemployment tax on any income you make at your job. Drivers for Amazons courier service should download the app on their smartphone.

Prev post How to Do Taxes For DoorDash 2020. In the File Manager app search for signed or delivered and tap the Amazon Flex app to open it. The general rule of thumb is to put away 30-35 of your Adjusted Gross Income income reduced by tax write-offs for taxes.

The most important thing to do is track your mileage and other deductions during the year. Gig Economy Masters Course. Make sure youre not making mistakes as a Flex driver these things could get you deactivated.

Amazon Flex will not withhold income tax or file my taxes for me. Sign in using the email and password associated with your account. The 153 self employed SE Tax is to pay both the employer part and employee part of Social Security and Medicare.

If you have more than one W-2 click on Add another W-2 from the summary screen.

We All Love Flexible Job Opportunity And Amazon Flex Is A Great Option Amazon Flex Is Now Coming To Flexible Jobs Amazon Flex Jobs Money Making Opportunities

Amazon Flex Driver How To File Your Taxes In 2022 1099 Nec Youtube

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

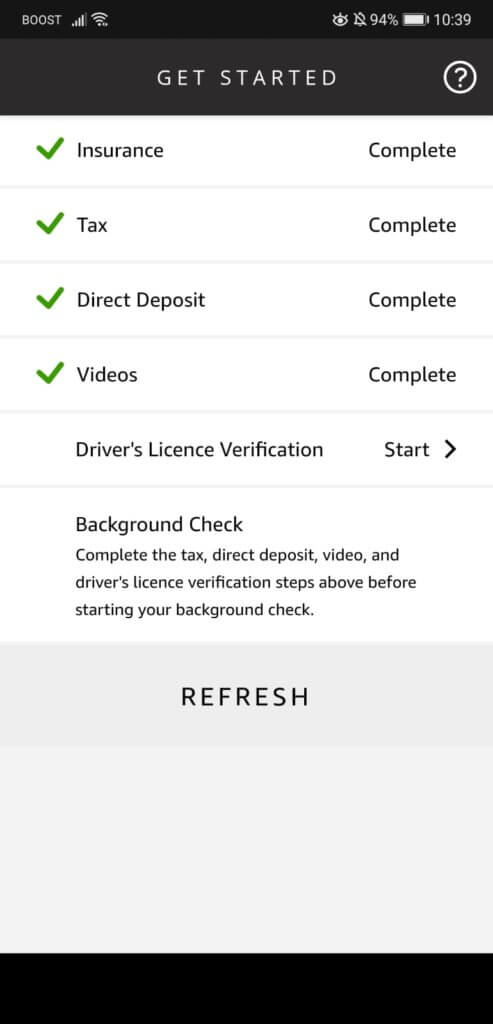

How To File Amazon Flex 1099 Taxes The Easy Way

How To Do Taxes For Amazon Flex Youtube

Amazon Flex Taxes Documents Checklists Essentials

Taxes For Amazon Flex 1099 Delivery Drivers Ultimate Guide

Triplog Automatic Mileage Tracking Made Easy

How To File Amazon Flex 1099 Taxes The Easy Way

![]()

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

Amazon Flex Filing Your Taxes Youtube

Nigerians To Present Their Tax Clearance Papers Before Getting New Passports Firs Boss Tunde Fowler Says Filing Taxes Nigeria Nigerian

How To File Amazon Flex 1099 Taxes The Easy Way

How To Manage Your Amazon Flex Income And Taxes With Accountable Accountable